![]()

Solution:-

From the given data,

draw the table of the given data and append other columns after calculations.

Now calculate Mean for x,

Mean ![]()

Where, n = number of terms ![]()

![]()

Variance for x= ![Rendered by QuickLaTeX.com \frac{1}{{{n}^{2}}}\left[ N\sum x_{1}^{2}-{{\left( \sum {{x}_{i}} \right)}^{2}} \right]](https://www.learnatnoon.com/s/wp-content/ql-cache/quicklatex.com-c802603d2dd59d8f961f5b119c552f2b_l3.png)

![]()

![]()

![]()

WKT Standard deviation = ![]()

![]()

![]()

So, co-efficient of variation ![]()

![]()

![]()

Calculate Mean for y,

Mean ![]()

Where, n = number of terms

![]()

![]()

Variance for y

![Rendered by QuickLaTeX.com =\frac{1}{{{n}^{2}}}\left[ N\sum y_{1}^{2}-{{\left( \sum {{y}_{i}} \right)}^{2}} \right]](https://www.learnatnoon.com/s/wp-content/ql-cache/quicklatex.com-5d7445ea04dcbd5a7babcd5b051d0685_l3.png)

![]()

![]()

![]()

![]()

WKT Standard deviation ![]()

![]()

![]()

So, co-efficient of variation ![]()

![]()

![]()

Compare C.V. of X and Y.

C.V of X > C.V. of Y

So, Y is more stable than X.

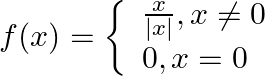

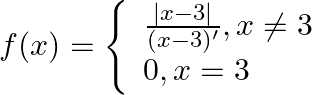

. Show that

. Show that  . Show that

. Show that